The Role of the Thrift Savings Plan in Federal Employees’ Early Retirement

The Thrift Savings Plan (TSP) is an invaluable asset for federal employees, offering them a robust framework for building a secure retirement. Similar to a 401(k) in the private sector, the TSP provides various benefits aimed at enhancing financial stability. For federal employees contemplating early retirement, a strategic approach to TSP contributions and withdrawals is crucial to ensure long-term financial health.

1. Avoiding Early Withdrawal Penalties

One of the foremost concerns for those looking to retire early is the penalty associated with early withdrawals. Typically, a 10% penalty is applied to TSP withdrawals if taken before reaching age 55. However, for federal employees retiring after age 55, this penalty can be avoided, providing a significant advantage. For those retiring even earlier, implementing Substantially Equal Periodic Payments (SEPPs) allows for penalty-free access to funds, albeit under strict IRS guidelines. This method enables retirees to draw from their savings while evading the usual penalties, thus safeguarding their financial reserves.

2. Leveraging Tax-Advantaged Accounts

Another effective strategy involves rolling over TSP balances into a Roth IRA. This move allows for tax-free withdrawals, offering retirees greater flexibility in managing their retirement income. By shifting assets into a Roth IRA, federal employees can let their investments grow without the burden of taxes, significantly boosting their long-term financial prospects. Such tax-advantaged strategies are not only beneficial for immediate cash flow but also enhance overall retirement savings.

3. Planning for Growth

A key component of any retirement plan is the growth of savings through compounding interest. By leaving TSP funds untouched as long as feasible, employees can maximize this effect, resulting in a more substantial income stream during retirement. Regularly reviewing and adjusting investment allocations within the TSP is essential to keep pace with evolving market conditions and personal financial goals. This ongoing management ensures that savings grow consistently and align with the retiree’s future needs.

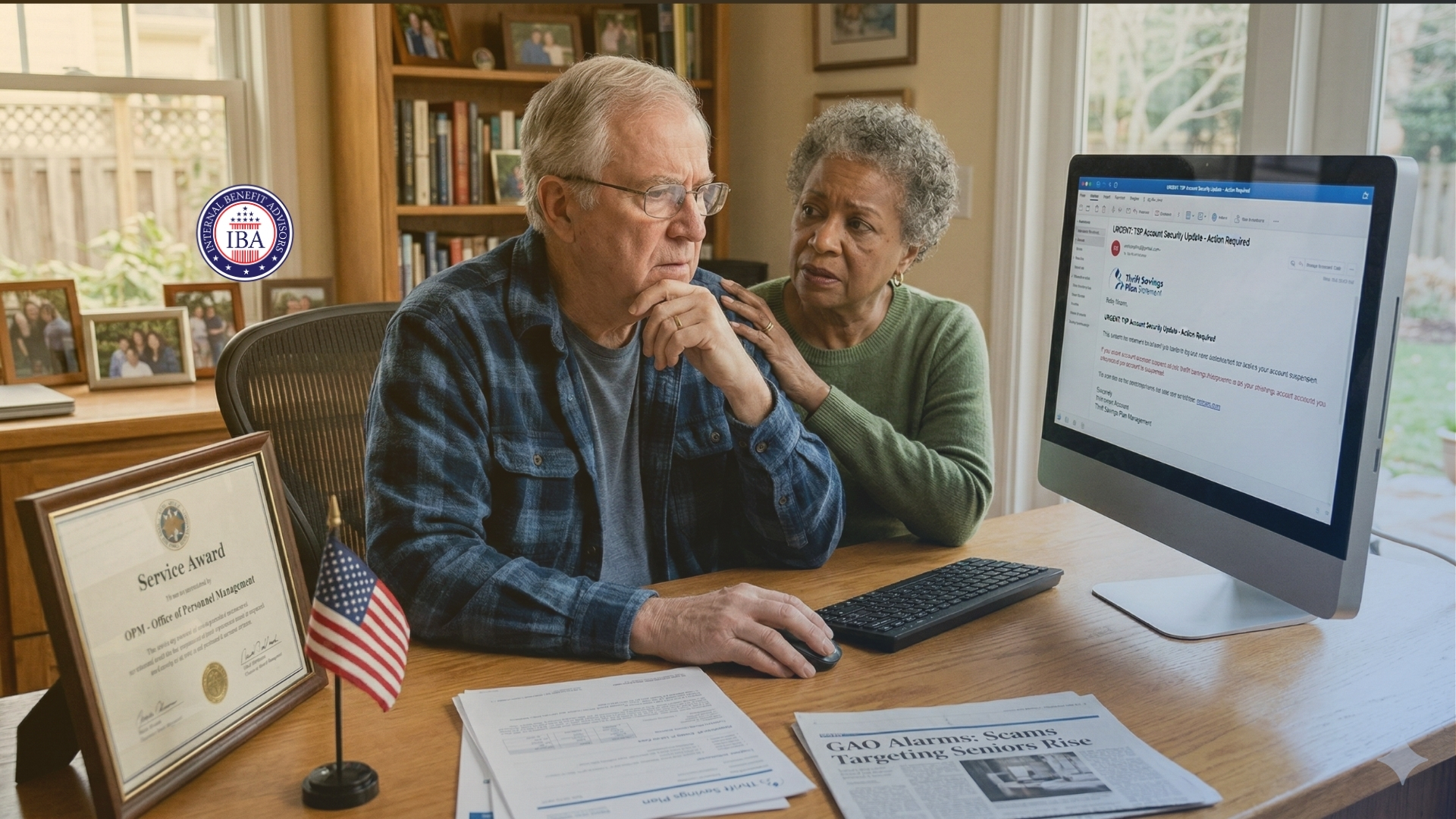

Expert Guidance for TSP Optimization

Navigating the complexities of retirement planning, especially regarding TSP strategies, often requires expert assistance. Financial advisors, such as those at Internal Benefit Advisors, offer specialized knowledge in optimizing federal employees’ retirement plans. These professionals can provide guidance on how best to integrate TSP strategies with overall financial goals, ensuring a seamless and effective retirement plan.

By exploring TSP insights with experienced advisors, federal employees can make informed decisions about their retirement strategy, enhancing potential outcomes and securing their financial future.

References:

Fed Employee Retirement Guide